Business Loans and Credit: A Comprehensive Guide

Business loans and credit are essential for growth and success in today’s competitive market. Whether you’re starting a new venture, expanding operations, or managing cash flow, understanding the intricacies of business financing is crucial. This guide will delve into the world of business loans and credit, exploring various options, eligibility requirements, and the importance of building a strong credit profile.

Understanding Business Loans

Business loans provide a lump sum of capital that businesses repay over a defined period, with interest. They can be used for a variety of purposes, including purchasing equipment, hiring staff, marketing campaigns, and inventory management. Choosing the right loan type is crucial and depends on your specific business needs.

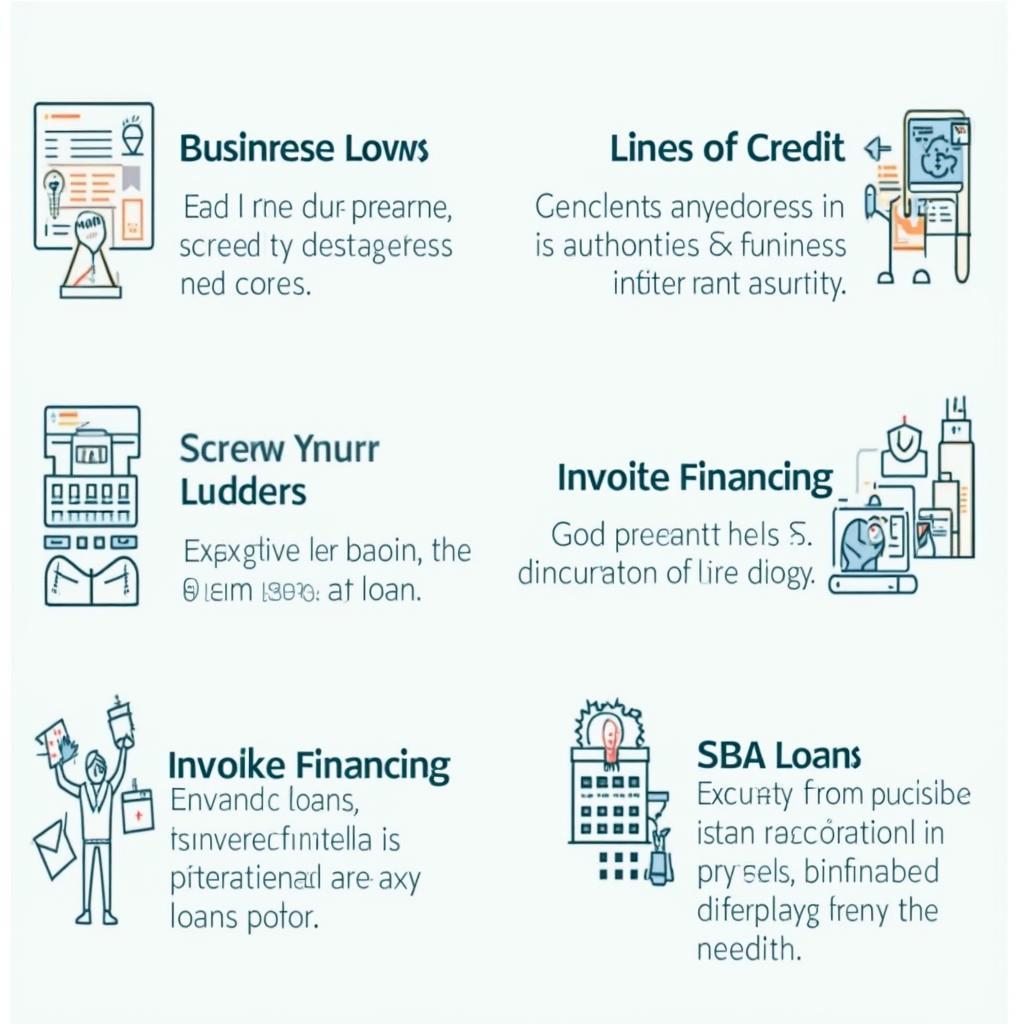

Types of Business Loans

Several types of business loans cater to different needs. Term loans offer a fixed amount with a set repayment schedule. Lines of credit provide flexible access to funds as needed. SBA loans, backed by the Small Business Administration, offer favorable terms for eligible businesses. Invoice financing allows businesses to borrow against outstanding invoices. Equipment financing provides funding specifically for purchasing equipment.

Types of Business Loans Explained

Types of Business Loans Explained

The Importance of Business Credit

Business credit refers to a company’s creditworthiness, reflecting its ability to repay debts. A strong credit profile is essential for securing favorable loan terms, attracting investors, and negotiating with suppliers. Building and maintaining good credit requires careful financial management and adherence to best practices.

Building a Strong Business Credit Profile

Several factors contribute to a strong business credit profile. Paying bills on time is paramount. Maintaining a healthy debt-to-income ratio demonstrates financial stability. Diversifying credit sources shows responsible credit management. Regularly monitoring your business credit report allows you to identify and address any inaccuracies.

How to Qualify for a Business Loan

Qualifying for a business loan involves meeting specific criteria set by lenders. Lenders typically assess your personal and business credit scores, financial statements, business plan, and time in business. Preparing a comprehensive loan application package increases your chances of approval.

Preparing for the Loan Application Process

Before applying for a business loan, gather all necessary documents, including financial statements, tax returns, and business licenses. Develop a realistic business plan that outlines your goals and how you intend to use the loan funds. Research different lenders and compare their loan terms and interest rates. loans in nigeria without credit check could be a starting point for exploring options.

Managing Business Loans and Credit Responsibly

Managing business loans and credit responsibly is crucial for long-term financial health. Making timely payments avoids penalties and strengthens your credit profile. Tracking your loan balances and interest rates helps you stay organized and informed. Communicating with your lender if you encounter any financial difficulties demonstrates proactive financial management. Similar to managing loans in kenya apps, responsible borrowing practices are essential.

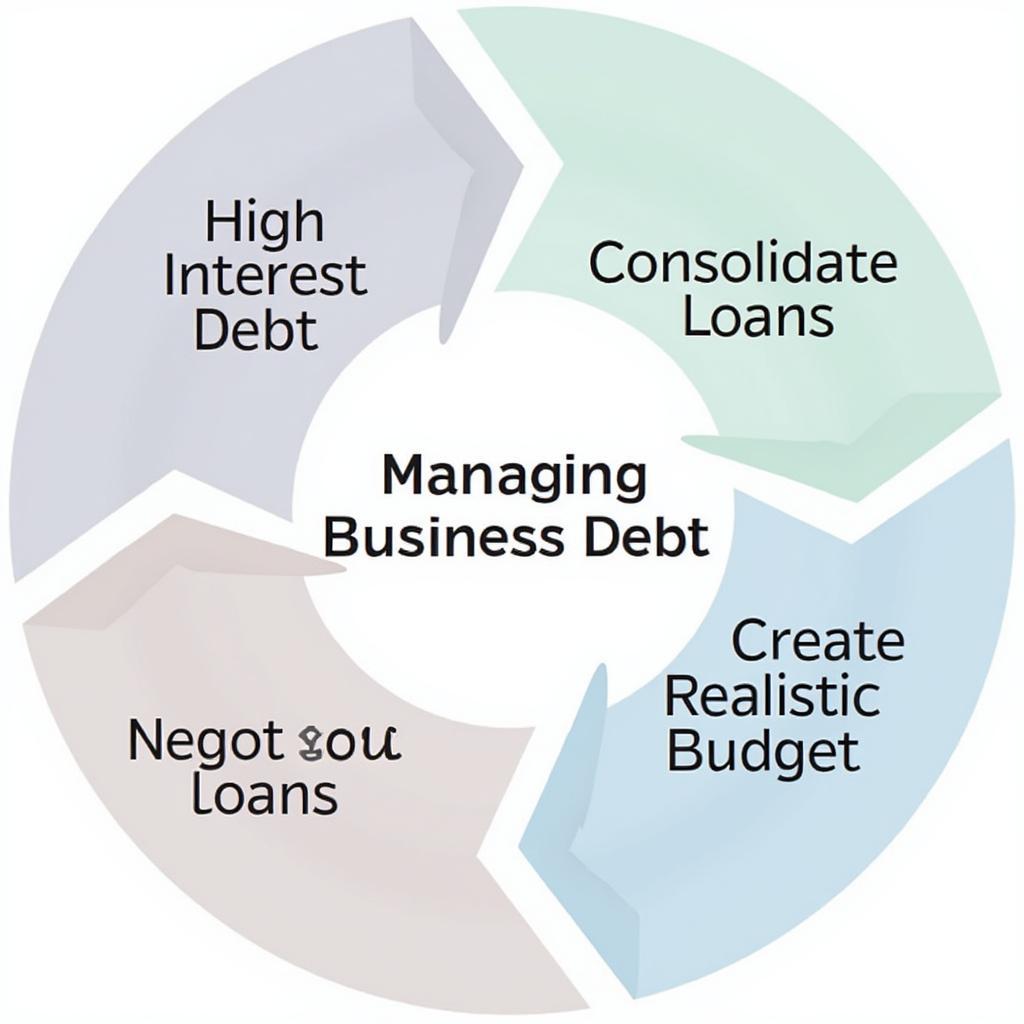

Strategies for Effective Debt Management

Implement effective debt management strategies to stay on top of your financial obligations. Prioritize high-interest debt to minimize overall interest payments. Consolidate multiple loans into a single loan with a lower interest rate if possible. Negotiate with lenders to adjust repayment terms if necessary. Just like strategies for bridge loans cape town, proactive management is key.

Effective Strategies for Managing Business Debt

Effective Strategies for Managing Business Debt

What are the common types of business loans?

Common types of business loans include term loans, lines of credit, SBA loans, invoice financing, and equipment financing.

How can I improve my business credit score?

You can improve your business credit score by paying bills on time, maintaining a healthy debt-to-income ratio, diversifying credit sources, and regularly monitoring your business credit report. Consider options like loans quincy il to explore different lending criteria.

What documents are needed for a business loan application?

Typically, you’ll need financial statements, tax returns, business licenses, and a well-defined business plan. Just like with sun loans decatur illinois, preparing these documents in advance can streamline the application process.

Conclusion

Business loans and credit play a vital role in the growth and success of businesses. Understanding the different types of loans, the importance of business credit, and the steps involved in securing financing are essential for making informed decisions. By carefully managing your business loans and credit, you can pave the way for a prosperous future. Navigating the world of business finance can seem daunting, but with the right knowledge and approach, you can leverage business loans and credit to achieve your entrepreneurial goals.