Personal Loans and Interest Rates: A Comprehensive Guide

Understand personal loans and interest rates before borrowing. This guide explores how interest rates impact loan costs, factors influencing rates, and tips for securing the best rates.

Understand personal loans and interest rates before borrowing. This guide explores how interest rates impact loan costs, factors influencing rates, and tips for securing the best rates.

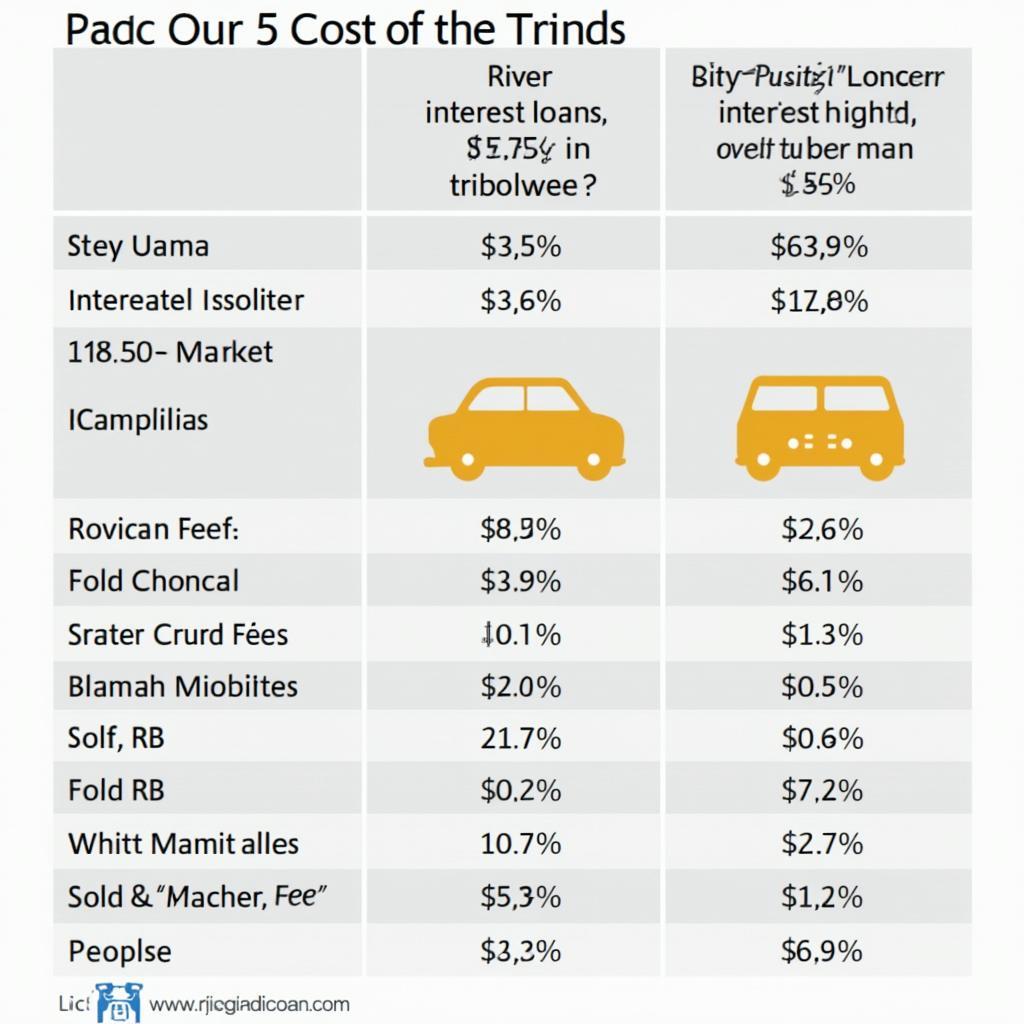

Is River Valley Loans real? Yes, but it’s a tribal lender with potential pros and cons. Learn about its legitimacy, interest rates, fees, and risks before making a borrowing decision.

Finbond loans East London offer various personal financing options, from short-term to longer-term solutions. Learn about the application process, benefits, risks, and responsible borrowing to make informed financial decisions.

Clear examples of loans and advances illustrate key differences. Explore various loans and advances examples, from personal and business loans to merchant cash advances, to make informed financial decisions.

Need funds before probate concludes? Learn what banks do inheritance loans: connect you with specialized lenders or offer guidance. Secure funds against your inheritance, not your credit, for immediate expenses.

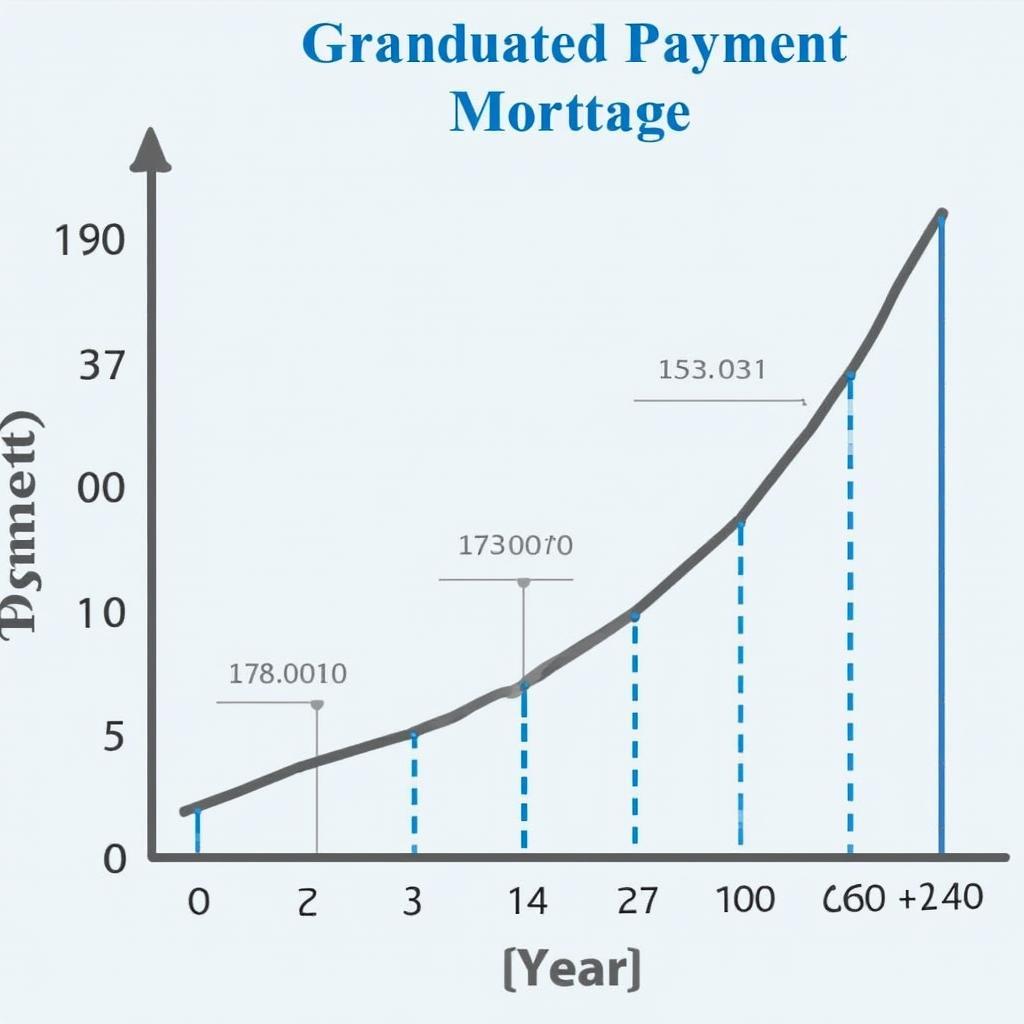

A graduated payment loan is a mortgage loan where initial payments are lower, then rise gradually. Understand the benefits, like easier homeownership access, but also risks such as potential negative amortization.

Need quick funds in Ghana? Explore emergency loans for unexpected expenses like medical bills or car repairs. Find the right loan type, eligibility criteria, and application process to make informed decisions.

Need personal loans in Jamaica? This guide covers eligibility, interest rates, repayment terms, and various loan types available. Make informed borrowing decisions and secure the best financing options in Jamaica.

How much down for a DSCR loan? Typically 20-25%, but it can range from 15-30% depending on factors like DSCR, loan amount, property type, and lender. A higher DSCR often means a lower down payment.

Can you use an FHA loan on a foreclosure? Yes, but specific FHA guidelines apply to these properties. Learn about the requirements, benefits, and process of using an FHA loan to buy a foreclosed home.